Alterra Lenders Remark 2022: Suits Underrepresented Borrowers That have Alternative Underwriting Alternatives, however, Costs and Charge Not Indexed On the internet

Alterra Mortgage brokers concentrates on financing to help you underserved organizations in the 34 says along with Washington, D.C. That it bank may help you score financing when you’re an initial-time homebuyer, try care about-working, inhabit a family having numerous types of income, need assistance which have a down-payment, otherwise use up all your a social Coverage amount, otherwise are in need of a spanish speaking loan officer.

Editorial Liberty

As with any of one’s lending company studies, our investigation isnt influenced by people partnerships or advertisements relationship. To learn more in the our very own scoring strategy, click the link.

Alterra Lenders Full Feedback

Alterra Lenders are a home loan company which had been established in 2006 which can be today part of Vista Home loan Group. The latest Vegas-centered bank now offers several loan affairs for the majority of products out of consumers, along with people that are mind-employed, need assistance along with their downpayment, otherwise features money regarding several provide.

Just like the an one hundred% Hispanic-owned providers, Alterra’s objective report states they aims to greatly help underrepresented resident communities. The organization claims 73% of the users was basically diverse and 62% were first-day consumers within the 2019. Many lender’s financing officials was fluent both in English and Language, which can only help multilingual people browse the brand new homebuying techniques.

Alterra Home loans: Home mortgage Items and you can Circumstances

Alterra Lenders has the benefit of mortgage loans to have individuals looking to purchase, remodel, otherwise re-finance a property. Toward lender’s selection now:

Alterra also helps borrowers through other homebuying hurdles, too. Including, the company’s underwriting design accommodates borrowers that are self-operating otherwise who live when you look at the houses in which numerous relatives contribute on the monthly bills.

The financial institution also offers a foreign national mortgage program where consumers are able to use a single taxpayer identification count (ITIN) in the place of a personal Coverage matter. To help you meet the requirements, consumers will need to offer a beneficial 20% deposit, let you know a couple of years’ worth of a position in identical brand of works, and offer their several latest tax returns using the ITIN. Such home loans come that have increased interest rate.

Alterra Lenders: Openness

Alterra Domestic Loans’ website doesn’t advertise mortgage prices or financial fees and offers very little facts about the products. Users wouldn’t select information regarding the kinds of money Alterra also offers, facts about qualification conditions, or of use tips regarding the financial techniques.

Borrowers can fill in an on-line function so you can request a phone phone call regarding that loan administrator or capable visit certainly one of the fresh lender’s within the-people department offices. I experimented with calling the lender a few times and you will did not apply at anybody, but we did discovered a visit-right back from that loan manager after filling in the internet mode. The affiliate gave factual statements about the borrowed funds processes and provided a price quotation instead a challenging borrowing from the bank pull.

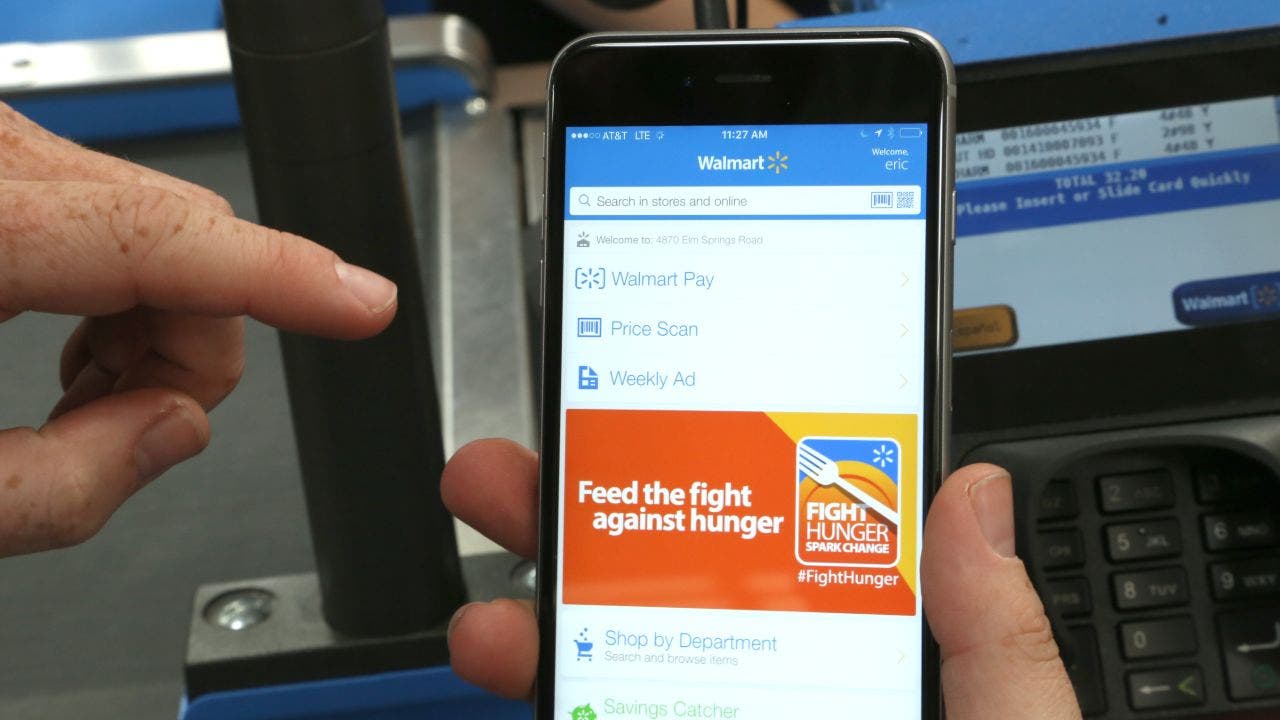

If you decide to complete a home loan software, you could potentially fill in you to definitely online or through the lender’s cellular software, Pronto And. Financing officer will get in touch with one install an account and you can finish the mortgage recognition techniques. You might song your application, upload data files, sign paperwork electronically, and you may make sure your employment on line.

Alterra Home loans: Home loan Cost and you may Charge

Alterra Home loans cannot promote rates towards the the webpages or bring a summary of charges consumers you will shell out at closure. not, they ong really loan providers. You may spend from the dos% to help you 5% of one’s house’s total cost from inside the fees, and additionally lender charges and you will and you will 3rd-party will cost you. Will cost you range between:

- Application and you will/otherwise origination payment payment

- Credit report charges (optional) prepaid costs

- Bodies taxation

- Recording fees

Financing qualification during the Alterra varies with every mortgage program. So you can qualify for a conventional mortgage, consumers you want a credit history of at least 620 and you may a lowest down-payment away from 3%. But with FHA finance, individuals you need a credit rating away from simply 580 with an all the way down commission of at least step 3.5%. Alterra in addition to need a get with a minimum of 580 to acquire a Va mortgage, if you will not need a downpayment.

Refinancing Having Alterra Mortgage brokers

Property owners which have a current home loan may be able to spend less or borrow money which have a refinance mortgage. Alterra’s web site will not give much facts about the re-finance techniques otherwise offer tips and you may interest rates, therefore you will have to get in touch with a loan officer to learn more. Alterra now offers:

, which allow you to get yet another rate of interest, financing name, or both. Property owners tend to use this style of loan to save money, lose personal home loan insurance rates, or key regarding a varying-rate home loan in order to a fixed-rate loan. , that allow you to definitely borrow cash using your house guarantee as the collateral. You might pull out home financing for more than you borrowed from, repay your current mortgage, next take on the real difference for the cash.